Market Intelligence for Today's Global Energy Industry

Market Intelligence for Today's Global Energy Industry

For more information contact:

EnergyPoint Research, Inc.

713-529-9450

info@energypointresearch.com

HOUSTON (January 22, 2020) – EnergyPoint Research announces final results from its 2020 Oilfield Products Customer Satisfaction Survey. The survey, which has been conducted annually since 2007, is one of several EnergyPoint studies focused on the oil and gas industry’s satisfaction with the products and services it utilizes and depends upon. More than 50 major products suppliers were listed in this year’s global survey. A total of 33 companies received the minimum number of evaluations to be included in the final rankings.

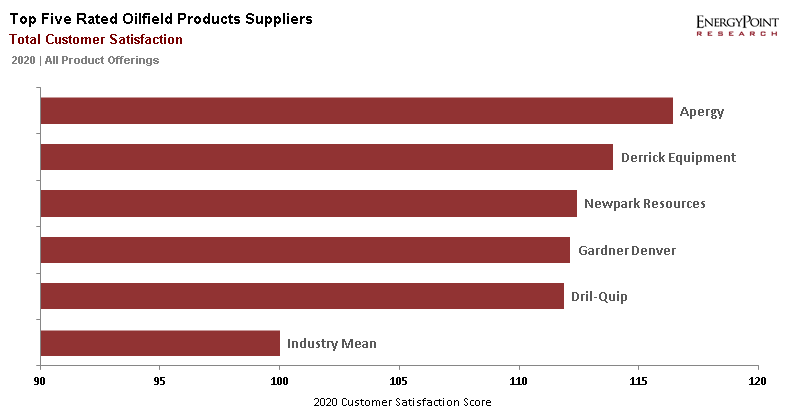

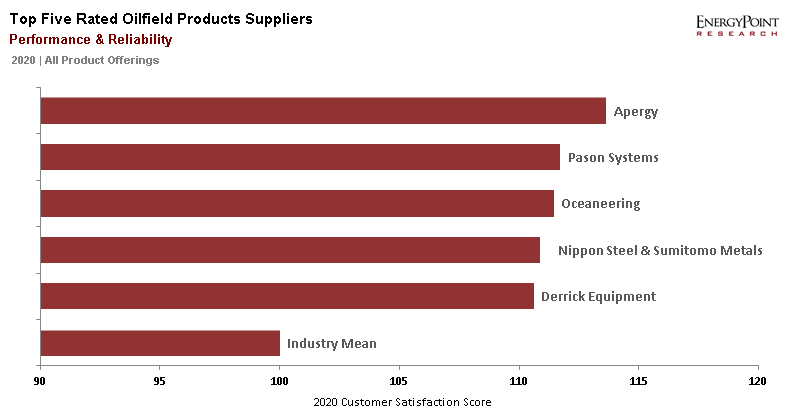

Apergy, an independent provider of wellsite equipment and related services—including artificial lift, flow control equipment and downhole tooling—received the top score in this year’s survey. This is the second consecutive year the Woodlands, Texas-based company garnered first place overall in the survey. The company also rated first in artificial lift, performance and reliability, digital oilfield, engineering and design, and four additional categories.

Derrick Equipment was this year’s runner up. The company rated first in five categories, including solids control equipment, rig-related equipment, offshore applications, and two additional categories. Newpark Resources, Gardner Denver and Dril-Quip round out the top five, each garnering the top rating in various product categories.

According to Doug Sheridan, Managing Director and founder of EnergyPoint, “Ratings in this year’s survey benefitted from a return to fundamentals—including performance and reliability of products. In addition, investments in technologies in the wake of the industry downturn that began more than five years ago have begun to bear fruit.” Sheridan added, “Many top-rated companies are now successfully leveraging digital oilfield features and offerings to improve the performance of their products and drive down customer costs. The results are evident in customer satisfaction levels.”

Listed alphabetically, companies rating first in at least one category in the survey include:

Other providers of oilfield products receiving the minimum number of evaluations to be included in this year’s final rankings include, in alphabetical order, Aker Solutions, Baker Hughes, Expro, Flowserve, Frank’s International, Omron IDM, Rolls-Royce, Wartsila, Weatherford International and Worldwide Oilfield Machine.

“One unmistakable takeaway from this year’s survey is the effect organizational instability and financial distress can have on supplier performance. For the first time, Baker Hughes and Weatherford—both of which have gone through significant reorganizations recently—failed to rate first in a single major product category,” Sheridan noted. “While many suppliers hope for a fresh start in 2020, it’s unclear if demand for oilfield products and services is sufficient to support the same number of market participants as in the past.”

The survey, which was global in nature and included more than 40 questions, was concluded on December 31, 2019. Questions focused on features and attributes shown to drive satisfaction among customers of oilfield product suppliers. These include pricing and contract terms, performance and reliability, engineering and design, availability and delivery, personnel, post-sale support, digital oilfield, and corporate capabilities. Respondents also evaluated companies across multiple product categories, applications and well types. Survey respondents were asked to rate providers of oilfield products with which they have had significant experience as customers within the last 24 months.

Final survey results reflect the opinions of more than 1,700 customer evaluations of major providers of oilfield products globally. For categories and companies in which qualifying ratings exist, scores from EnergyPoint’s 2016 and 2017 surveys were included in this year's category‑winner calculations at lesser weightings than 2018 and 2019 evaluations. In no case were 2016 and 2017 ratings assigned a weighting of more than 20 percent on a combined basis for purposes of calculating final ratings and rankings.

Full survey results are included in EnergyPoint’s soon-to-be-released 2020 Oilfield Products Ratings & Analysis Report. The report will include detailed ratings from the survey for all 33 companies. The report also includes analysis of overall trends and drivers of customer satisfaction in the oilfield products sector as revealed by this year’s survey results.

For questions concerning EnergyPoint's surveys or reports, contact EnergyPoint at info@energypointresearch.com or at +1.713.529.9450. Information concerning EnergyPoint’s promotional policies and research offerings can be found at the following online locations:

Licensing and Promotional Policy & Program: www.energypointresearch.com/licensing

Ratings & Analysis Reports: www.energypointresearch.com/detailed-reports

EnergyPoint Research conducts independent research regarding customer satisfaction in the global energy industry. Founded in 2003, the firm publishes its closely watched annual customer satisfaction ratings and rankings in several segments, including land drillers, offshore drillers, oilfield products, oilfield services, midstream services, and gasoline retailing. For more information concerning EnergyPoint and its independent surveys, visit the company’s website at www.energypointresearch.com.